take home pay calculator madison wi

Calculate your Wisconsin net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Wisconsin paycheck calculator. The assumption is the sole provider is working full-time 2080 hours per year.

Free Wisconsin Payroll Calculator 2022 Wi Tax Rates Onpay

Take home pay is calculated based on up to six different hourly pay rates.

. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. Just enter in the required info below such as wage and W-4 information and our tool will perform the necessary calculations. The assumption is the sole provider is working full-time 2080 hours per year.

Wisconsin Cigarette Tax. Wisconsin Salary Tax Calculator for the Tax Year 202223. Employers must match this tax dollar-for-dollar.

The Wisconsin Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Wisconsin State Income Tax Rates and Thresholds in 2022. Chula Vista Two Bedroom Condos Wisconsin Dells Condo Rentals Chula Vista Resort Wisconsin Dells Wisconsin Dells Waterpark Park Resorts. This Wisconsin hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Details of the personal income tax rates used in the 2022 Wisconsin State Calculator are published below the. If youre eligible for a 10000 bonus you might only come away with just over 6000 of. The latest budget information from April 2022 is used to show you exactly what you need to know.

If youre eligible for a 10000 bonus you might only come away with just over 6000 of it once taxes are applied. This is the 19th-highest cigarette tax in the country. Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Cigarettes are taxed at 252 per pack in Wisconsin. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Wisconsin. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and.

Based on an annual salary of. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Wisconsin. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Take home pay calculator madison wi. For Medicare tax withhold 145 of each employees taxable wages until they have earned 200000 in a given calendar year. Living Wage Calculation for Madison WI.

The federal minimum wage is 725 per hour while Wisconsins state law sets the minimum wage rate at 725 per hour in 2022. We issue a wage attachment for 25 of gross earnings per pay period. Calculate your take home pay from hourly wage or salary.

Note that bonuses that exceed 1 million are subject to an even higher rate of 396 Now 25 may not seem like all that much but if. Wisconsin state income tax is a graduated tax which means that the percentage of tax owed increases as income increases. 232 rows How much do you make after taxes in Wisconsin.

Also called manufactured homes mobile homes used as a dwelling receive a 35 sales tax exemption which means the remaining 65 is taxed at the full sales tax rate. Living Wage Calculation for Wisconsin. Demands for a living wage that is fair to workers have resulted in numerous location-based changes to minimum wage levels.

The most typical earning is 52000 USDAll data are based on 292 salary surveys. The process is simpler than you think. Wisconsin Salary Paycheck Calculator.

Take home pay calculator madison wi. The calculation is based on the 2022 tax brackets and the new W-4 which in 2020 has had its first major. The 2022 wage base is 147000.

Switch to Wisconsin hourly calculator. The tax rates which range from 354 to 765 are dependent on income level and filing status. There are also a number of deductions and credits.

Our calculator has been specially developed in. Use ADPs Wisconsin Paycheck Calculator to calculate net take home pay for either hourly or salary employment. Bonuses are considered supplemental wages and as such are subject to a different method of taxation.

Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. Wisconsin Mobile Home Tax. View future changes in the minimum wage in your location by visiting Minimum Wage Values in.

It can also be used to help fill steps 3 and 4 of a W-4 form. This calculator is intended for use by US. The tool provides information for individuals and households with one or two working adults and.

Most employers tax bonuses via the flat tax method where an automatic 25 tax is applied to your payment. The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. Well do the math for youall you need to do is enter the applicable information on salary federal and state.

You are able to use our Wisconsin State Tax Calculator to calculate your total tax costs in the tax year 202223. The first 11770 of taxable income is taxed at 4 the next 23540 is taxed at 584 the next 47080 is taxed at 765 and any income over 77640 is taxed at 897. Hourly rates weekly pay and bonuses are also catered for.

For the Social Security tax withhold 62 of each employees taxable wages until they hit their wage base for the year. Switch to Wisconsin salary calculator. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Wisconsin.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Sample Car Loan Amortization Schedule Template Car loan. Why not find your dream salary too.

Wisconsin Mortgage Calculator Fast Easy Find Low Wi Rates Mortgage Payment Mortgage Calculator

Outdoor Decor Somatic Cell Outdoor

Wisconsin Paycheck Calculator Smartasset

Wisconsin Income Tax Calculator Smartasset

Ergonomic Office Desk Chair And Keyboard Height Calculator Human Solution 14 5 Interior Design Kitchen Contemporary Ergonomics Furniture Cool Office Desk

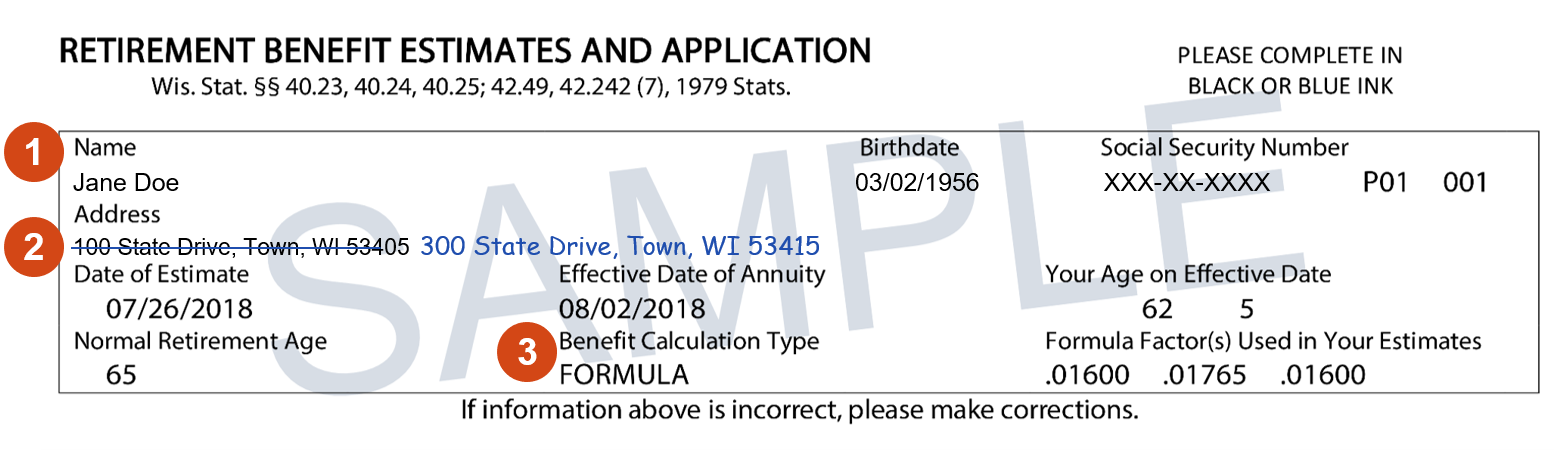

How To Fill Out Your Retirement Benefit Estimates And Application Etf

Wisconsin Child Support Calculators Worksheets 2022 Sterling Law Offices S C

Milo Milo Appleton Resale Appleton Linwood Milo Furniture

Wisconsin Property Tax Calculator Smartasset

Pin By Amy Sausen On Uw Madison Type One Diabetes Type 1 Diabetes Diabetes

Corn N Rate Calculator Agriculture Apps Farms Com App Technology University Of Wisconsin Madison Life Science

The Home Buying Road Map How To Buy A House Home Buying Process Home Buying First Time Home Buyers

Your Offer Office Of Student Financial Aid Uw Madison

Fast Facts Admissions Uw La Crosse La Crosse College Planning Fast Facts

Wisconsin Paycheck Calculator Adp

Wisconsin Alimony Calculator 2022 Sterling Law Offices S C

Pin Van Michael Francis Op Diet Ideas Ketosis Diet Keto Diet Recipes Keto Supplements

Wisconsin Income Tax Calculator Smartasset

Off Grid Solar System Sizing Calculator Unbound Solar Off Grid Solar Off The Grid Solar