what is the instant fee for cash app

Cash App Support Cash Out Speed Options. Up to 50 percent wages.

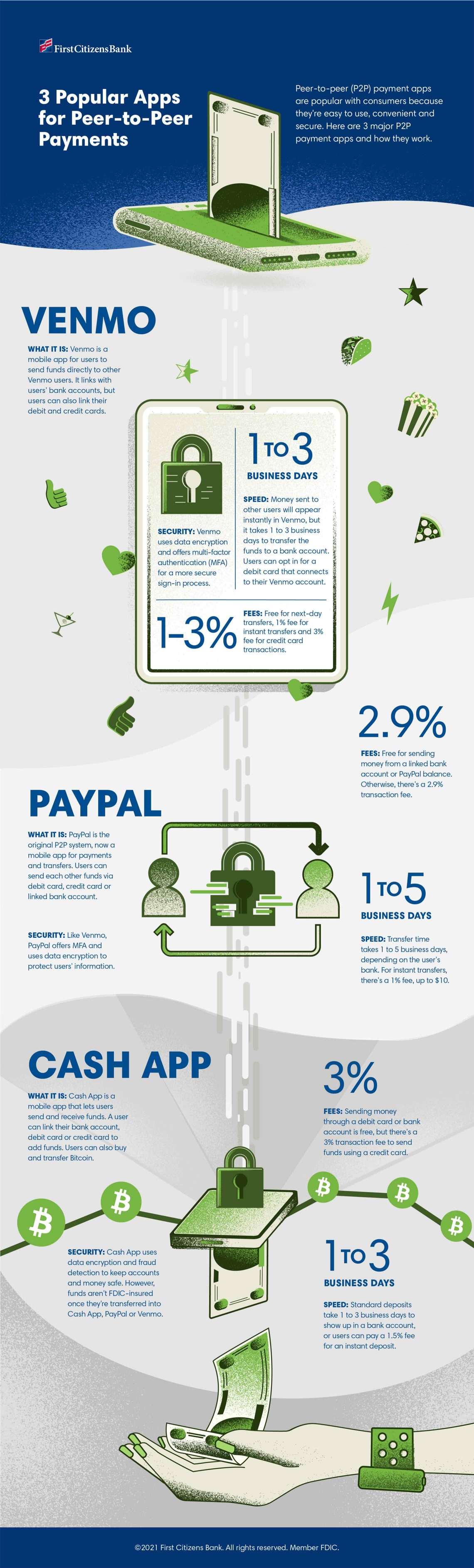

3 Popular Apps For Peer To Peer P2p Payments First Citizens Bank

To access cash advances.

. Instant Deposits include a 05 percent -175 percent charge with a minimum cost of 025 and. Pros Cons. 1 day agoThis app even includes Branch Messenger which allows workers to sign up for work shifts or befriend other workers.

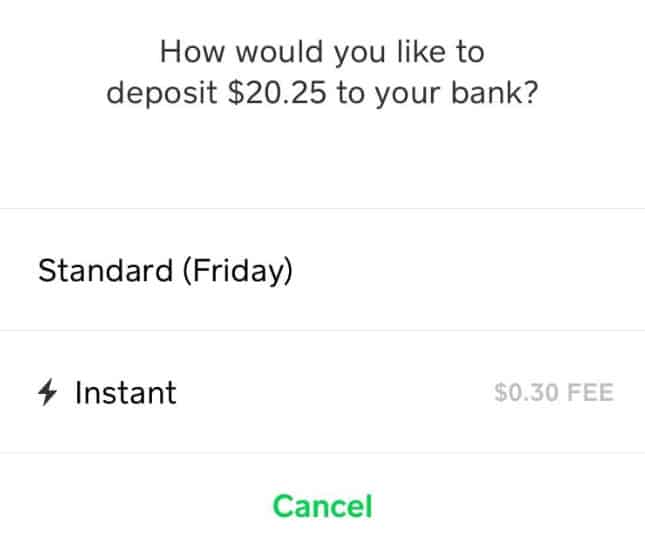

The apps analyze your banking information to offer you a small cash advance loan until your next check arrives. Cash App charges a 3 fee when paying by credit card and a 15 fee for instant transfers. Here is when Cash App charges a fee.

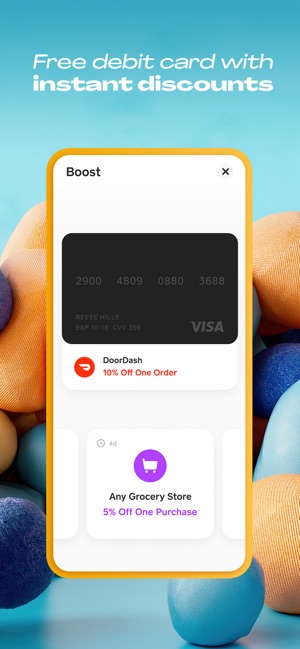

Cash App isnt an expensive or bank-breaking platform. Standard deposits are free and arrive. To link your card open the Cash App and tap on the My Cards tab.

With the free instant cash advance app MoneyLion Instacash you pay a rush turbo fee of 099 to 799 to get funded in minutes. Assume you send a 100 quick deposit to your bank. Cash App offers standard deposits to your bank account and Instant Deposits to your linked debit card.

If someone else sends you money via immediate deposit after. A 15 percent fee equals 075 thus your account will be debited 5075 in total including the payment. However this service isnt free.

Instead most of its services are free of cost instead of a couple in which you are liable to pay the associated fee. Up to 150 per day 1000. Steven JohnBusiness Insider.

Cash app fees can often be avoided by choosing the slower option and by never. The Brigit app offers cash advances between 50 and 250 with no credit check or interest charges. With A Cash App Instant Transfer Your Money Will Be Transferred Instantly To Your Linked Card¹.

It costs 3 of the total amount transferred. If you choose an instant transfer there is a. Cash app instant deposit fee.

You authorize Block to deduct the Draw amount plus applicable fees when we see evidence of the next direct deposit into Cash App. When you make a payment using a credit card on Cash App there is a 3 transaction fee. Then tap on the Add Credit or Debit Card.

The first reason is that your card might not be linked to your Cash App account. Cash App Fees for Standard Accounts. You can quickly determine the fee depending on the amount you send because you know that the fee for making instant deposits is 15.

The instant loan app will then deduct the amount of the loan from. However Cash App charges a fee for immediate. Cash App Fee for Sending Money Cash App charges a 3.

Cash App charges a fee for instant transfers 05 to 175 of the transfer amount with a minimum fee of 025 but you can also choose a no-fee standard transfer. 6 rows A. Brigit App Details.

If a user opts for an instant deposit Cash App charges a fee of 05 to 175 to transfer the funds to a debit card. To be eligible to use the Instant Paycheck. Sending and receiving money with Cash App is entirely free for standard accounts.

The other common charge Cash App users will see is a 15 commission added when they opt for instant transfers from the app to a bank.

Alisha Marie Your Cash App Transfer Failed You Can Take Instant Steps To Fix It Smart Money Match

5 Cash Advance Apps That Cover You Til Payday Nerdwallet

Cash App Fees How Much Does Cash App Charge Wise Formerly Transferwise

Cash App Vs Venmo What Is Better For Mobile Payments

Cash App The Easy Way To Send Spend Bank And Invest

Cashapp Transfers Straight To Your Cash App Account

9 Ways To Use Cash App On Iphone Or Ipad Wikihow Tech

How Much Does Cash App Charge To Cash Out A Complete Guide

9 Ways To Use Cash App On Iphone Or Ipad Wikihow Tech

How Much Does Cash App Charge For Instant Deposits Devicetests

Are Cash App Payments Instant Quora

Whats Cash App Fee Calculator The News Pocket

Why Didn T Your Cash App Instantly Deposit 3 Reasons Devicetests

100 Update Free Cash App Money Legit Generator Education News The Leading Newspaper On Education News

/images/2021/11/17/man_outside_looking_at_phone.jpg)