michigan gas tax increase history

Per MCL 2071010 the owner of motor fuel held in bulk storage where motor fuel tax has previously been paid to the supplier at the lower rate would owe the difference between the. Effective January 1 2017 the motor fuel rate which.

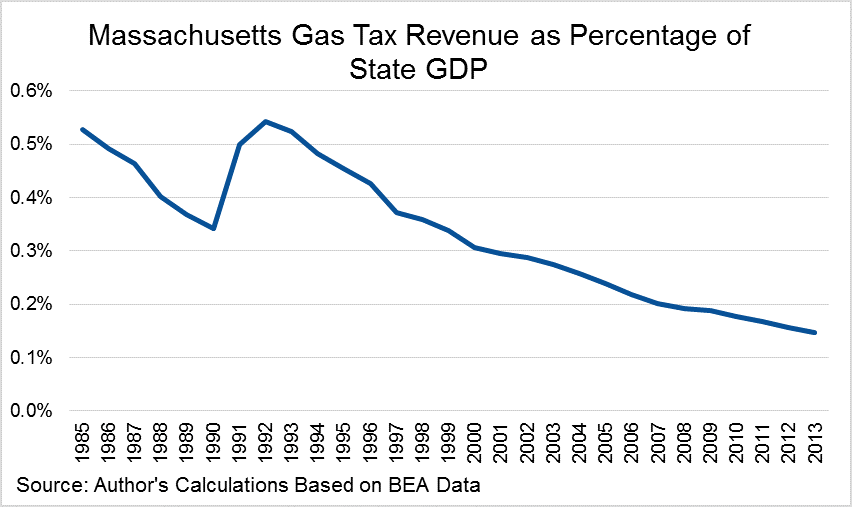

Massachusetts Ballot Referendum Challenges Gas Tax Indexing Tax Foundation

On January 1 2022 Michigan drivers started paying a tax of a little more than 27 cents per gallon for the state motor tax aka gas tax.

. The Department has set the current rate at 33. Cent of tax was 466 million. The legislation requires Michigans Department of Treasury to increase tax rates concomitant to inflation.

How much is the Michigan gas tax. Payment of Michigan Fuel Excise Taxes Payments of fuel excise taxes are made by fuel vendors not by end consumers though the taxes will be passed on in the fuels retail price. Mar 25 2020 The Center Square State gas taxes and fees in Michigan amount to 42 cents per gallon the ninth highest rate among the 50 states according to an analysis by.

Michigans Democratic Gov. AAA reports the average price per gallon. The gasoline tax of 19 cents a gallon will increase by 73 cents and the diesel tax of 15 cents a gallon will go up 113 cents with automatic annual inflationary adjustments in.

Michigans net annual spending increase will total 825. Gretchen Whitmer proposed a 45-cent gas tax increase that would be phased in over two years in three increments. With the mid-year tax rate increase gasoline tax revenues were up 2696 million from the prior fiscal year.

Raise the 19-cents-gallon gasoline tax and 15-cent diesel tax by 73 cents and 113 cents to 263 cents starting in 2017. Although the sales tax is not imposed upon. In Michigan three taxes are included in the retail price of gasoline.

The 187 cents per gallon state gas tax and the 184 cents per gallon federal fuel tax. Gas and Diesel Tax rates are rate local sales tax varies. Despite Recent Price Increase Gas Prices 1980 - May 2000 Figure 1 GASOLINE PRICES AND TAXES IN MICHIGAN by David Zin Economist.

Michigan gas tax increase history Thursday May 19 2022 Edit. Chart The Population Rank Of Every U S State Over 100 Years Go West Young Man And Infographs Pop. The gas tax will rise by 56 cents per gallon under the last stage of an increase approved by lawmakers in 2017As in Illinois Californias gas tax rate will now also be.

The Federal gasoline tax 184 cents per gallon the Michigan sales tax levied at a rate of 60 on a base that includes the. Each time you purchase gasoline in Michigan youre paying a couple of road-user fees as well. Gas prices will be the most expensive ever for the holiday.

Effective January 1 through December 31 2022 Michigans gas tax rates have fluctuated but they currently sit at 0272 per gallon. The state excise tax is 75 cpg on gas and diesel additional 138 ppg state sales tax on diesel 118 ppg state sales tax on gasoline. The goal Whitmer said.

This is an increase of 83 over 2021 bringing travel volumes almost in line with those in 2017.

The Problem With The Gas Tax In Three Charts

Vehicle Miles Traveled Vmt Tax Highway Funding Tax Foundation

Is It A Plan To Fight Climate Change Or A Gas Tax Tci Facing Fierce Pushback

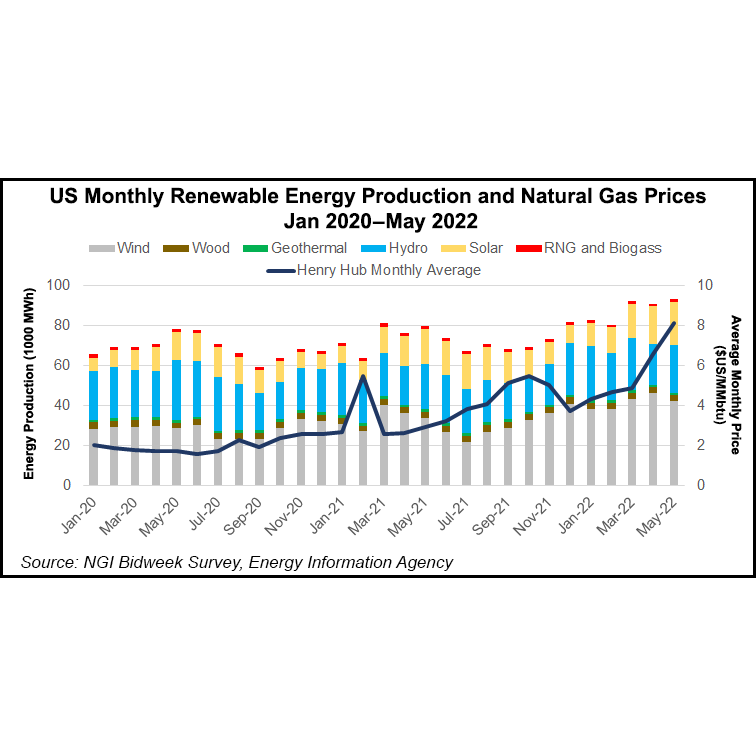

Big Implications Seen For U S Oil And Natural Gas Industry If Inflation Reduction Act Passes Natural Gas Intelligence

Governor Whitmer S 45 Cent Gas Tax Increase 7 Questions

Michigan S Gas Tax How Much Is On A Gallon Of Gas

Michigan Sales Tax Increase For Transportation Amendment Proposal 1 May 2015 Ballotpedia

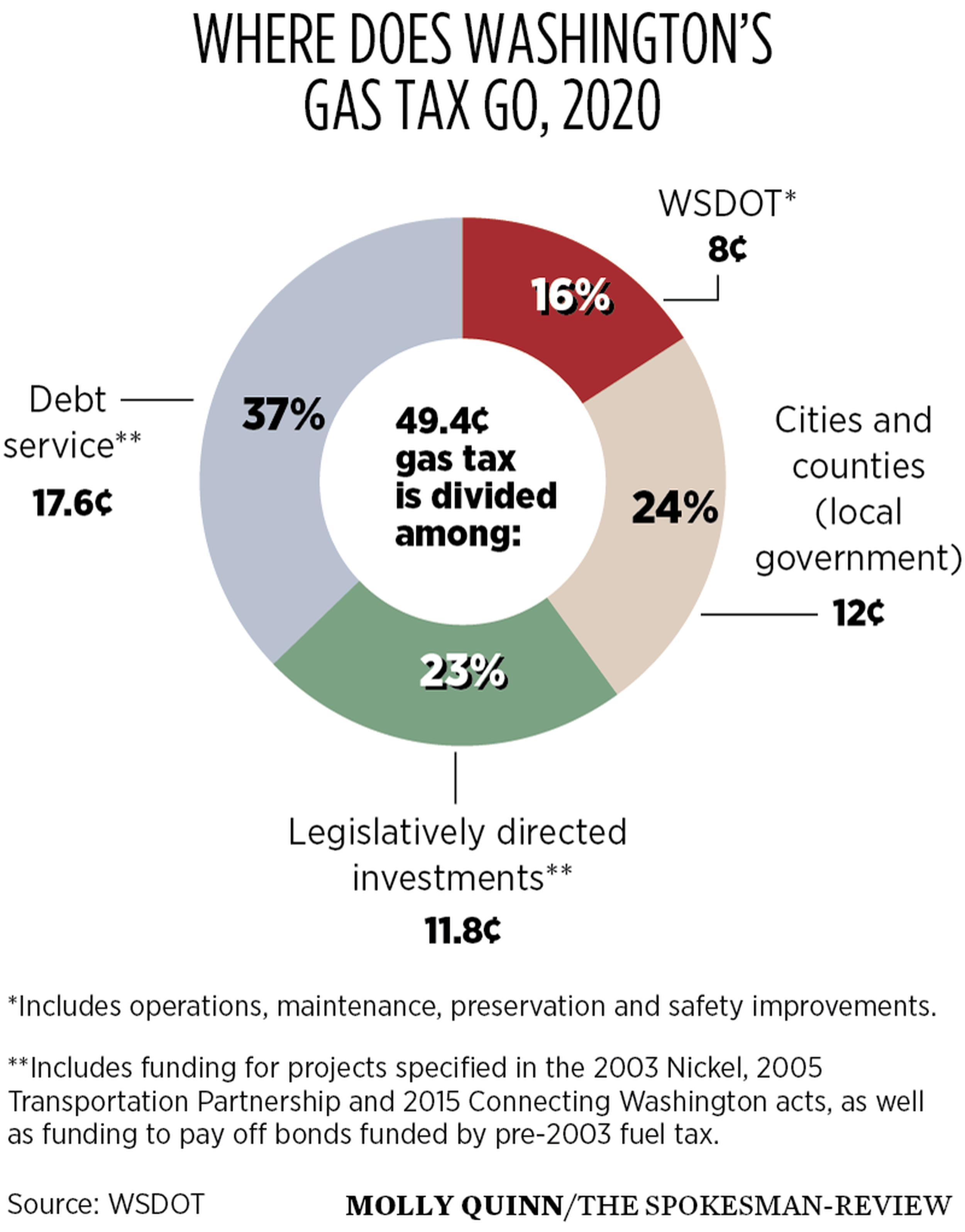

Getting There As Gas Tax Revenue Drops Washington Department Of Transportation Could Face 40 Funding Decline Delay Projects The Spokesman Review

Michigan Gas Tax Going Up January 1 2022

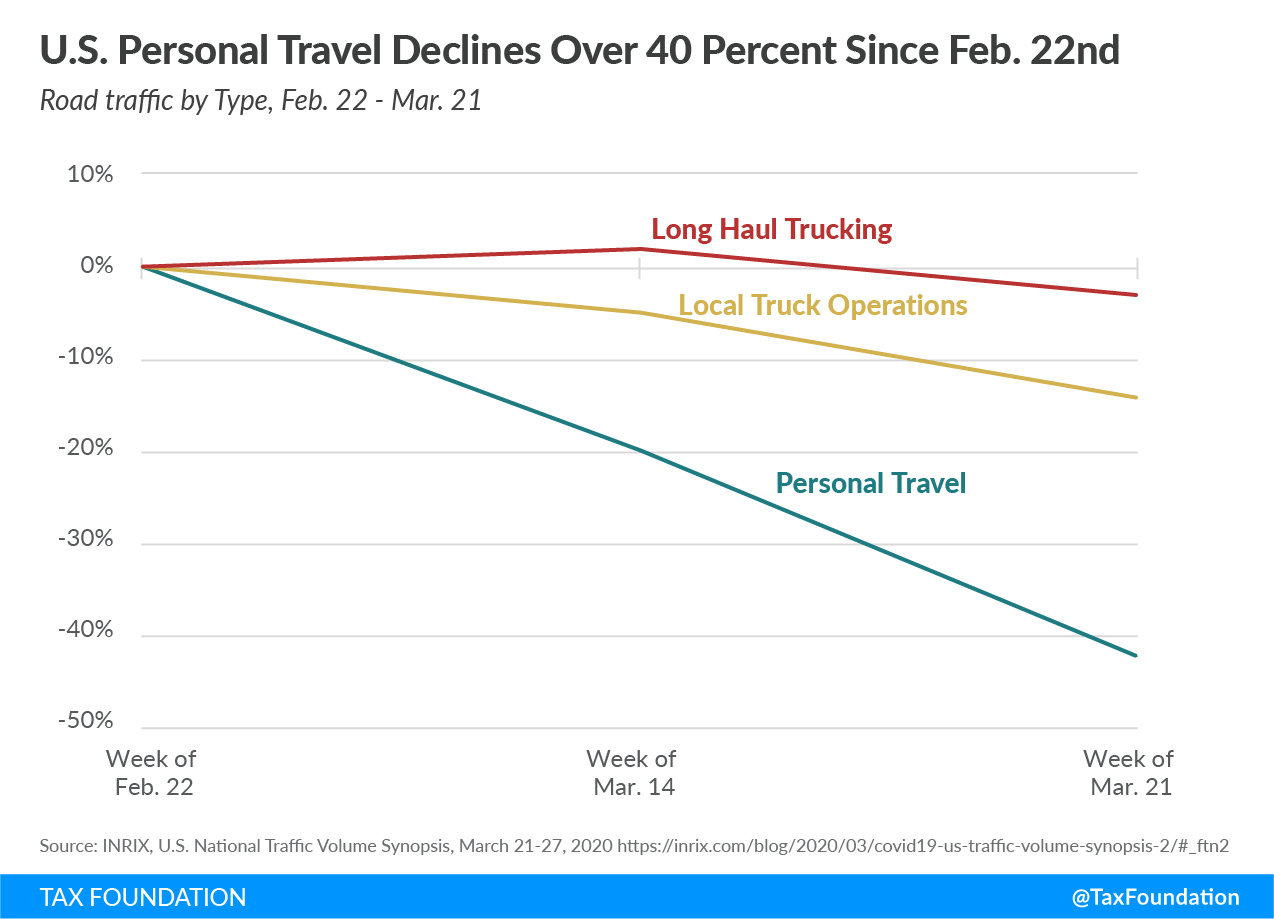

Gas Tax Revenue To Decline As Traffic Drops 38 Percent

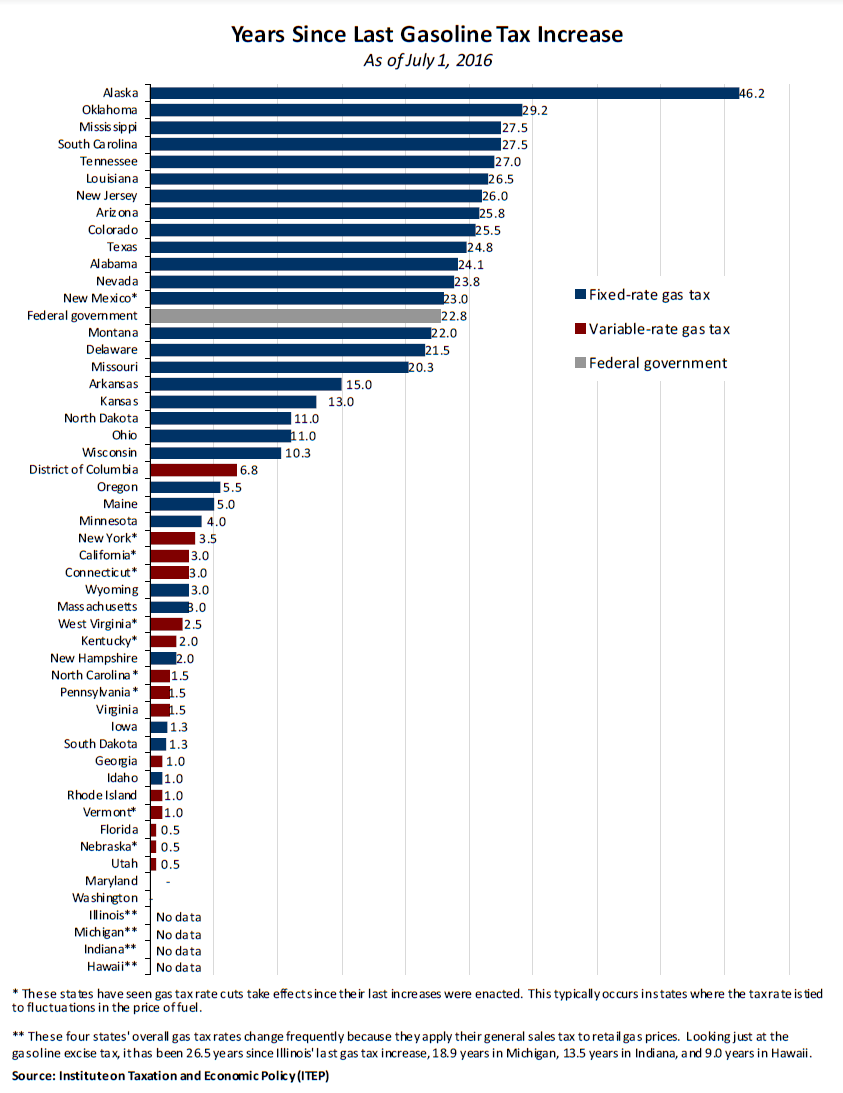

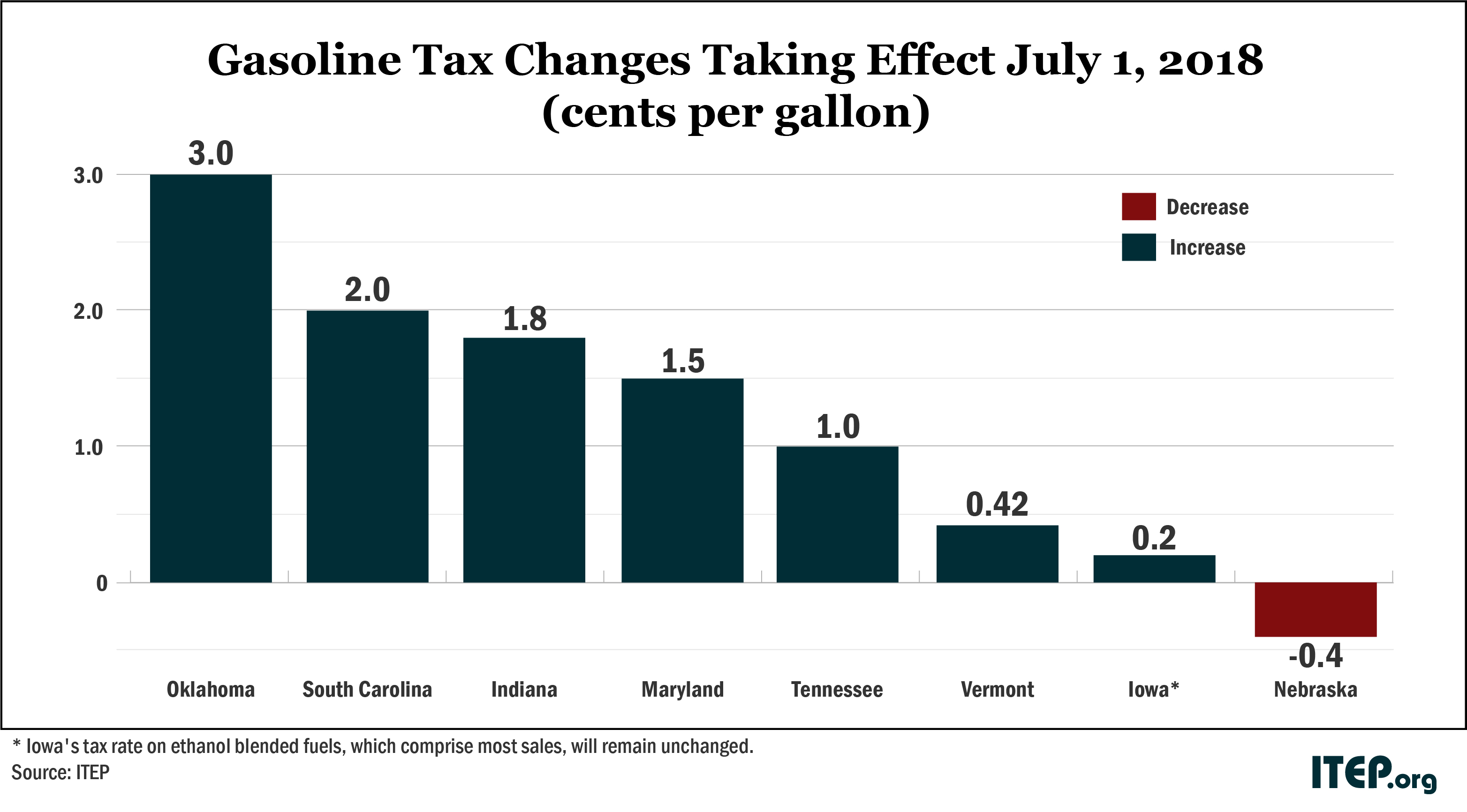

Gas Taxes Rise In Seven States Including An Historic Increase In Oklahoma Itep

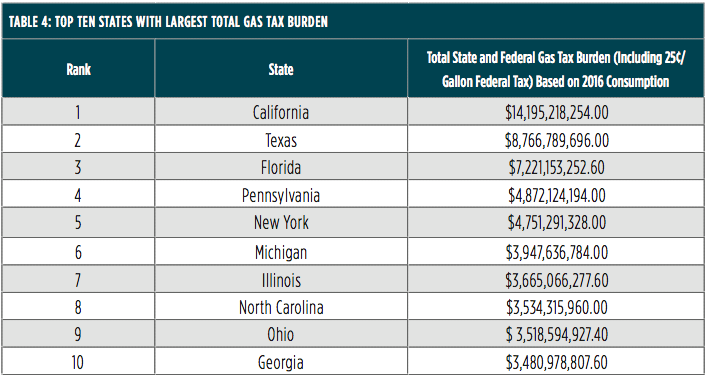

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger

Gas Station Association Prepared To Add Truth To Illinois Mandated Gas Tax Sticker Illinois Thecentersquare Com

Gov Whitmer Proposes Raising Gas Tax By 45 Cents To Fund Michigan S Crumbling Roads Mlive Com

Every American Stands To Lose Under Unprecedented Gas Tax Increase

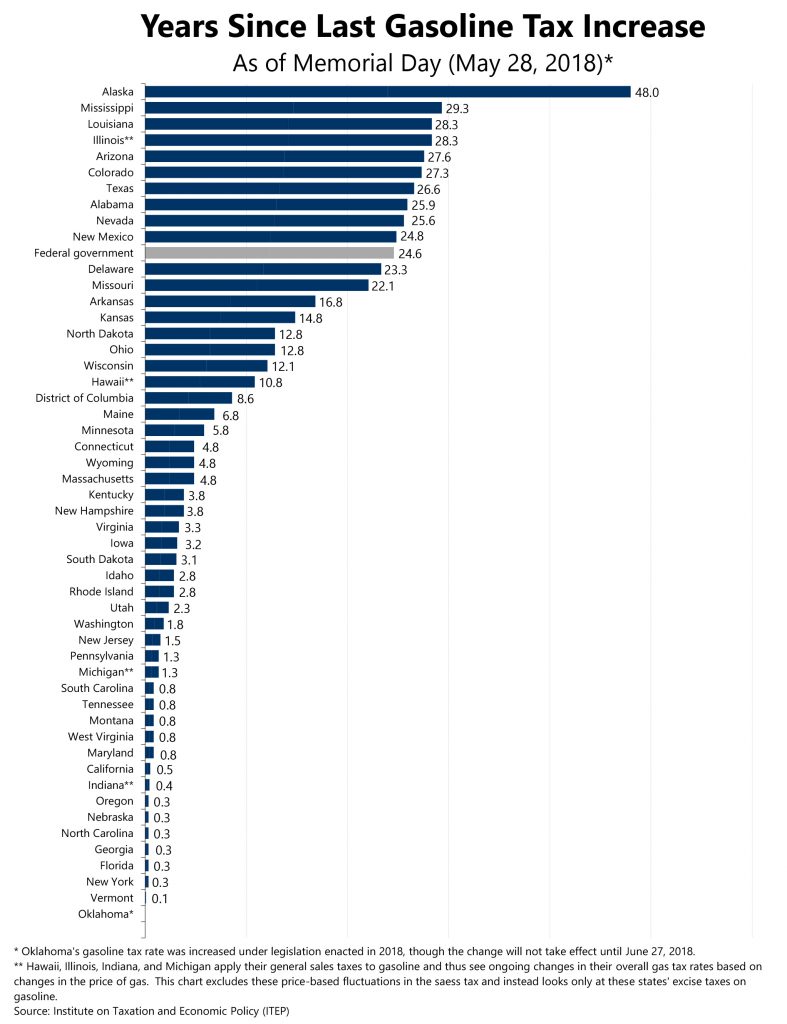

How Long Has It Been Since Your State Raised Its Gas Tax Itep

See How Much A 45 Cent Michigan Gas Tax Might Cost You Bridge Michigan

Just In Time For 2021 Inflation Spike Michigan Gas Tax Getting Cost Of Living Increase Michigan Capitol Confidential